Russia claims fDi Diversification Index hat-trick

Russia continues to lead the fDi Diversification Index, followed by Ukraine and Ecuador. Cathy Mullan reports.

Russia remains the commodity-based economy with the most balanced mix of FDI sectors, according to a study by fDi Magazine.

The country scored 0.233 in this year’s fDi Diversification Index, welcoming more than 4600 inward investments between 2003 and 2017 across 39 sectors, according to greenfield investment monitor fDi Markets. Comparing the concentration of FDI in Russia over the 10 years to 2017, a notable shift has occurred. Services-based investments have slowed in favour of more industrial operations, such as manufacturing and logistics. Russia also topped the index in 2017 and 2016.

All change

In examining the top five sectors for FDI in Russia over the 10-year period, financial services and business services accounted for 9.7% and 7.4%, respectively, of all investment in the country between 2008 and 2012. Between 2013 and 2017, these figures had declined to 5% and 3.7%, respectively. Meanwhile, industrial machinery increased from 8.1% to account for 10.6% between 2013 and 2017, while the food and tobacco sector more than doubled from 5.7% to 11.5% of total projects.

Similarly, when studying the top five business functions for investments into Russia between 2008 and 2017, business services and sales, marketing and support projects have given way to manufacturing and logistics operations. Between 2008 and 2012, manufacturing operations accounted for one-third of all investments. During the 2013 to 2017 period, this increased to 46.1%.

Companies investing in Russia are moving from more tertiary-level operations to more secondary-level ones, at a time when sanctions imposed by the US and EU are continuing to be imposed alongside counter-sanctions from Russia. In 2014, Russia imposed counter-sanctions on importing agri-food, which was followed with a customs crackdown on EU food imports in August 2015. The ban on importing food was then extended to Ukraine in 2016. Russian counter-sanctions, first introduced in the sector in 2014, corresponded with a spike in FDI in the country’s food and tobacco sector. Eleven projects were recorded in 2014, which increased to 31 in 2015 following the introduction of the measures. This increase in projects has been maintained up to 2017 and looks set to continue in 2018.

Ukraine's wide spread

Ukraine ranks second in this year’s diversification index, scoring 0.278 – attracting investment in 38 sectors. Financial services remained the most attractive sector for investors, accounting for 12.4% of all projects between 2008 and 2017. Software and IT projects made up 10.1% of all FDI and food and tobacco investments closely followed with 9.9%.

In total, 25 locations were ranked based on the level of diversification in their FDI. A strong correlation exists between the number of FDI projects a commodity economy receives and how diversified it is. Broadly speaking, the higher the number of investments, the more diversified a location is likely to be.

Methodology

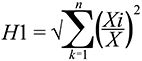

The index analysed 25 commodity economies across 39 FDI sectors to determine how diversified their levels of greenfield FDI have been since 2003. fDi used the Hirschman Index for export diversification as a base and calculated a score for FDI projects and capital investment using data from greenfield investment monitor fDi Markets, using the following formula:

The scores for each location ranged between zero (fully diversified) and one (fully specialised). The lower the score, the more diversified the economy in terms of FDI; the higher the score, the more concentrated.

The fDi Diversification Index is a weighted average of the fDi Diversification Score for FDI projects and FDI capital investment. For FDI projects, the result is the square root of the sum of the square of the number of projects in sector x, divided by the total number of projects, for each of the sectors whereby the location receives FDI. The index then applies equal weight (50%:50%) to both projects and capital investment figures to give the overall index score.

The list of locations was devised by analysing economies with at least 40% of their goods exports derived from commodities and a minimum of 25 inward greenfield FDI projects. Thirty-three economies met the criteria.

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.